illinois employer payroll tax calculator

The Employer Services Hotline at 800. Newly-created businesses employing units must register with IDES within 30 days of start-up.

Employer Payroll Tax Obligations When Employees Work Out Of State Anders Cpa

The Illinois Paycheck Calculator uses Illinois.

. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. Illinois child support payment information. Unemployment insurance FUTA 6 of an employees first 7000 in.

What Are Employer Unemployment Insurance Contribution Tax Rates. Calculating your illinois state. Online - Employers can register through the.

There is an allowance of 2375. The following points apply to Illinois payroll taxes. Calculating your Illinois state income tax is similar to the steps we listed on our Federal paycheck calculator.

Illinois State Disbursement Unit. Just enter the wages tax withholdings and other information required. For more IDES employer contact information or call.

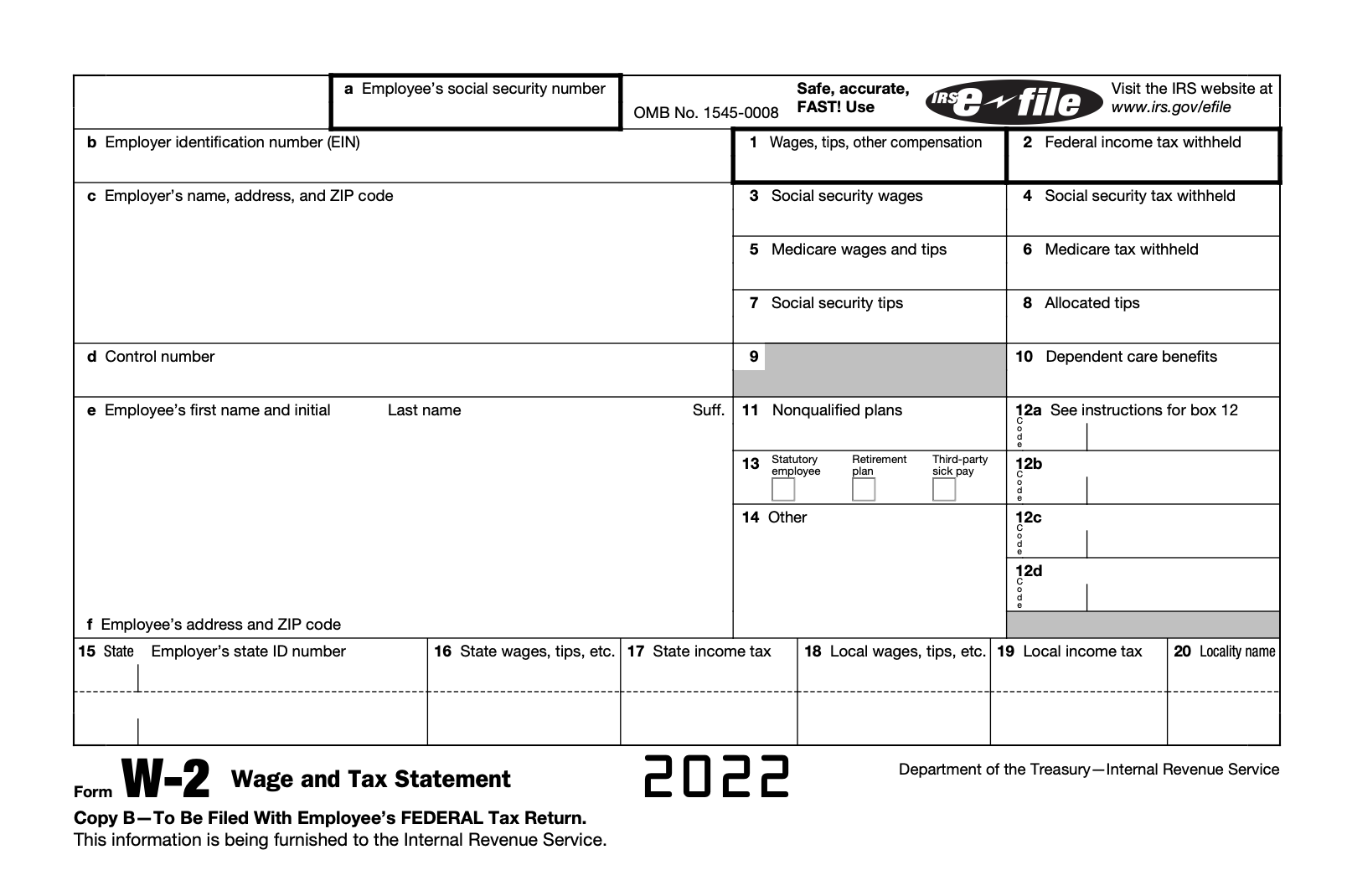

Remit Withholding for Child Support to. Also these chart amounts do not increase the social security Medicare or FUTA tax liability of the employer or the employee. So the tax year 2022 will start from July 01 2021 to June 30 2022.

Starting with the 2018 tax year Form IL-941 Illinois Withholding Income Tax Return. As of January 1 2022 the minimum wage in Illinois is 1200hour. The maximum an employee will pay in 2022 is 911400.

Payroll tax in Illinois can be utilized to fund the Medicare program and the Social Security program. Total Estimated Tax Burden 27857. On the state level you can claim allowances for Illinois state income taxes on Form IL-W-4.

You may pay up to 050 less an hour for. The standard FUTA tax rate is 6 so your max. Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck.

This procedure only applies to nonresident alien employees who. Your employer will withhold money from each of. Thus to calculate net income for payroll taxes the.

Use ADPs Illinois Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Percent of income to taxes 37. Latest payroll taxes rates related laws for the state of Illinois.

If you are unable to file electronically you may request Form IL-900-EW Waiver Request through our. Payroll withholding calculator 2010 postalda from postaldamyblogit Calculates federal fica medicare and withholding taxes for all 50 states. For assistance on Illinois payroll tax.

State Experience Factor Employers UI Contribution Rates - EA-50 Report for 2017 EA-50 Report for 2018 EA-50. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. In 2022 the illinois state unemployment insurance sui tax rate will range from 0725 to 71 with a maximum.

Illinois payroll tax calculator info for business owners and payrollHR managers. Created with Highcharts 607. Carol Stream IL 60197-5400.

The maximum an employee will pay in 2022 is 911400. Mail completed forms and payments to. Different rates apply to tipped employees and employees under 18 years of age.

Calculate Illinois Child Support Il Free Calculator

Bonus Tax Rate 2022 How Bonuses Are Taxed And Who Pays Nerdwallet

Illinois Paycheck Calculator Adp

How To Register File Taxes Online In Illinois

Illinois Salary Calculator 2022 Icalculator

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Paycheck Calculator Take Home Pay Calculator

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

Payroll Tax Rates 2022 Guide Forbes Advisor

How To Calculate Payroll Taxes Methods Examples More

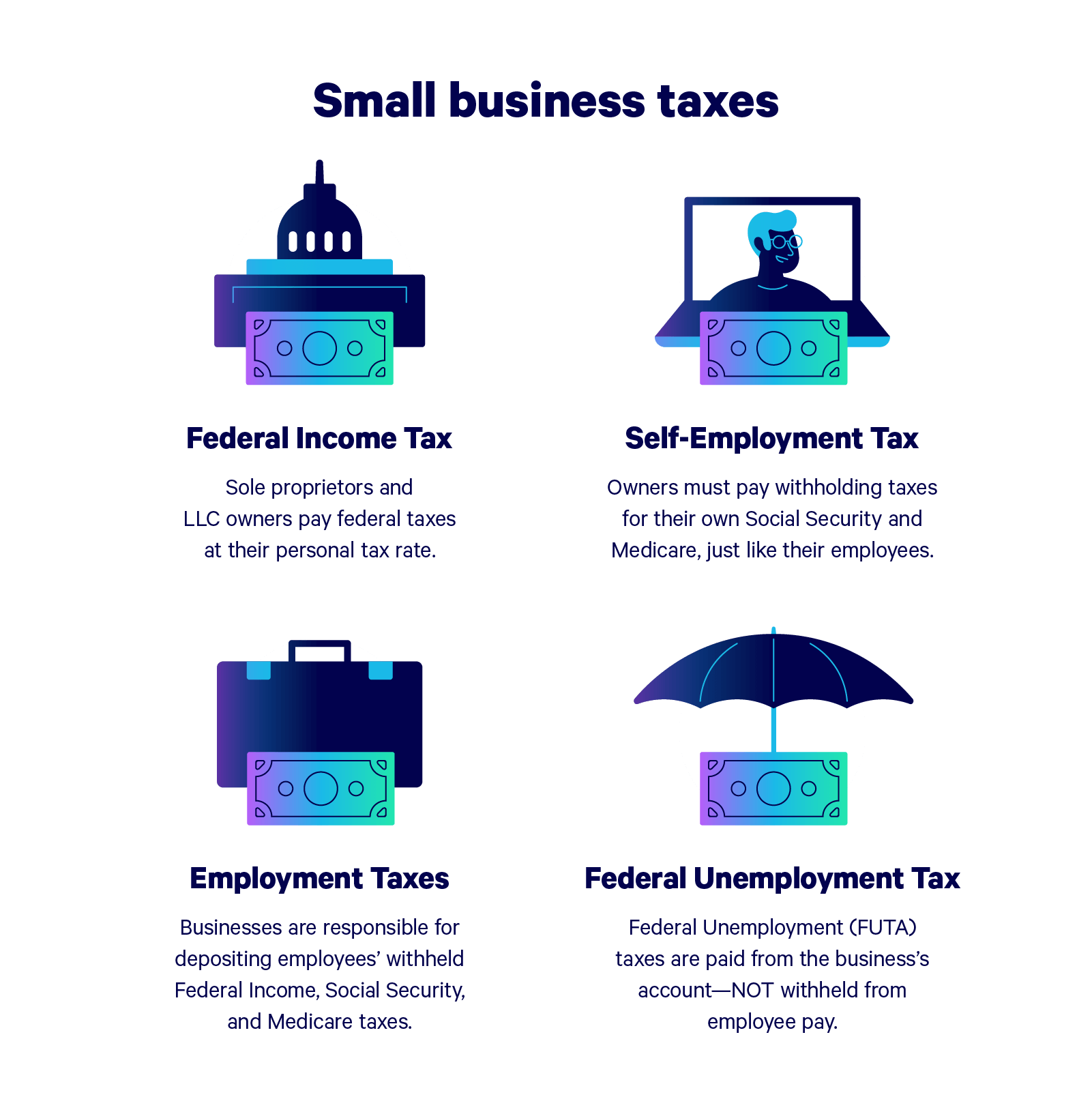

Llc Tax Calculator Definitive Small Business Tax Estimator

Illinois Payroll Services And Regulations Gusto Resources

What Are Employer Taxes And Employee Taxes Gusto